National Tax Training School is the only licensed and nationally accredited educational institution that is devoted to teaching tax preparation. Teaching is not a side business, it is their main business.

From NTTS site:

The primary purpose of National Tax Training School is to train our students so that they are proficient enough to work immediately after graduation and become qualified tax professionals. Other courses such as those given by nationally franchised tax return preparation services, are typically given only before the tax season and are designed primarily to train its students to work for them on their proprietary computerized system preparing simple individual tax returns, and more complicated returns are usually referred to the office manager. While their course is adequate for that purpose, many of those trainees and employees come to NTTS to receive further training.

This is not just a "see if you can do better on your own taxes" course. It is far more advanced than that. You can find out better ways to do your taxes, don't get me wrong. This course from the National Tax Training School actually prepares you to take the IRS Registered Tax Preparer (RTRP) exam.

It is a self-paced course which can be finished in as little as 8 weeks (if you are highly motivated) or up to a year. The course is broken down into 20 individual units. Each unit is written with current tax laws and information. After your reading, there is a self-grading quiz to take and also a test to mail in to your instructor.

NTTS does not leave you on your own through this journey of tax law and returns, you are assigned a skilled instructor, a practicing accountant who is current on all tax preparation procedures as well as the day to day realities of operating a professional tax practice. And depending on what option you choose to enroll with, you will have help for up to 4 years after completing the course.

The Federal Course includes topics such as present income tax law, classification of taxpayers, Who is considered married?, and much more. Each area is packed full of information to study in order to prepare you for a career in income tax preparation. You do not need to have previous tax preparation experience in order to take this class.

The cost for the Federal Course depends on the amount of support time you would like. For 4 years of support, the cost is $795.00. Two years of post-graduate support is $495. National Tax Training School offers several payment plan options to make this course affordable for those who would like to take it.

For those with previous tax experience, National Tax Training School offers the Higher Course in Federal Taxes. This course allows you to qualify for the highest fees as a Full-Service Tax Consultant and to successfully take the IRS EA Enrolled Agent Exam.

Some of the main topics covered in the Higher Course in Federal Taxes:

Individuals

- Determination of Tax

- Gross Income: Inclusions

- Gross Income: Exclusions

- Property Transactions: Capital Gains and Losses

- Deductions and Losses

- Itemized Deductions

- And many more

Corporations

- Tax Research

- Corporate Formations and Capital Structure

- The Corporate Income Tax

- Corporate Nonliquidating Distributions

- Other Corporate Tax Levies

- And many more....

The cost of the Higher Course in Federal Taxes is $745.00. National Tax Training School offers payment plan options for all their coursework.

National Tax Training School also offers California Residents who are required to obtain a CA Tax Preparer License in addition to registering with the IRS, the California Tax Preparer Course.

How did my experience go?

I received a very large notebook neatly organized, Lessons were put together with their quizzes and tests. I cannot tell you how much information is included. It's a bit overwhelming, but definitely all needed.

So far I am making slow progress through the course. I am definitely not on track for one of those prodigy tax preparers who will finish it in the 8 week time frame. Each assignment area takes me about 2-3 hours to read to understand. I then go back through and double check the notes I make in the column areas before I take my self-check examination.

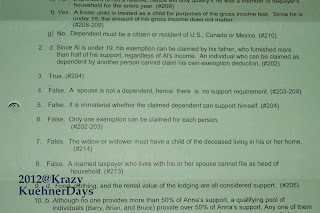

The self-check examination are great because it not only tells me the answer, but the reason that would be the answer. So the explanation is made clear to avoid confusion due to the amount of laws. It was a bit of a pain though trying to cover the answers when it's written directly underneath the question. I did use a spare sheet of paper to cover the answers, but if I moved it too much I would discover the answer anyway.

When I finished the self-check examination, I would work on the mail-in test. It took about a little over a week turn around time for the test to make it back.

Each test was thoroughly checked and an answer sheet with explanations provided.

NTTS is working on an online version for the examinations. They currently have the first 10 lessons they are working with. I can see the exams being a good thing, due to immediate feedback. But I cannot imagine trying to read the amount of information for each lesson on my computer screen. But I personally still prefer a good old-fashioned paper book to reading a book on a computer screen, especially when it comes to studying material.

NTTS supports not only you as a student attempting to learn tax law, but they also want to help you to start a tax practice. I am not sure if I want to take it that far, but I will receive the information to open my own business if I choose to.

I really do like this program. In our current economy it is always a good thing to have a second option to fall back on in case the family needs it.

I understand that the cost is a little high for families on a strict income, but this program is accredited and approved as a Continuing Education Provider for the IRS. The cost provides support for you whether it is just on the tax program or if you are starting your own tax preparation business. And you can receive this support for up to four years depending on the program you choose. National Tax Training School does provide many different payment options for families to choose from.

If I were to be looking into a program to start, National Tax Training School would have been my choice to start training for tax preparation work. I am able to work at my own pace, and yet have feedback on how I am doing on my work. The program is chocked full of information so that I know that I am being presented with the most current laws. Each section is small enough to not be overwhelming, and still be covering pertinent information that is needed.

So if it's for mom and dad or even your high school student who is looking for extra work once they have graduated and headed for college, National Tax Training School has an option for families.

Several other Crew Mates were given the a chance at trying this program for their families. Please visit the Schoolhouse Review Crew blog to see how it worked for them.

*****Disclaimer......I received Federal Tax Course from NTTS free of charge for the sole purpose of this review. I was not required to write a positive review. The views I have expressed are my own and are real experiences with my family. I am disclosing this is accordance with the Federal Trade Commission's 16 CFR, Part 255 http://www.access.gpo.gov/nara/cfr/waisidx_03/16cfr255_03.html>:"Guides Concerning the Use of Endorsements and Testimonials in Advertising."

No comments:

Post a Comment